Choosing the right business structure is crucial for any entrepreneur. It affects taxes, liability, and operations. Different types of business structures exist, each with its own benefits and challenges. Understanding these options can help you decide what is best for your goals. Sole proprietorships, partnerships, corporations, and limited liability companies (LLCs) all offer unique features. Each structure serves different needs based on size, risk, and tax implications.

Selecting the right one can influence your business’s success and growth. This guide will explore the various types of business structures. You’ll learn how each one works and what factors to consider when making your choice. With the right information, you can set your business on the path to success.

Sole Proprietorship

A business structure is the legal way a business is organized. Each type has its own rules and tax implications. One common type is the sole proprietorship. This is the simplest form of business. It is owned and run by one person. This structure is popular for small businesses and freelancers. It allows for easy setup and full control over operations.

Benefits

Sole proprietorships come with several advantages. Understanding these can help you decide if this structure is right for you.

- Easy to set up: Starting a sole proprietorship requires minimal paperwork. You often just need a business license.

- Full control: As the sole owner, you make all the decisions. This means you can run your business as you see fit.

- Tax benefits: Business income is taxed as personal income. This can lead to lower overall taxes.

- Low cost: Operating expenses are usually lower than other business types. You do not have to pay for corporate taxes or extensive legal fees.

Here’s a quick comparison of sole proprietorship benefits:

| Benefit | Description |

| Easy Setup | Minimal paperwork and formalities. |

| Complete Control | You make all business decisions. |

| Tax Simplicity | Income taxed as personal earnings. |

| Low Overhead | Fewer costs compared to other structures. |

Drawbacks

While sole proprietorships offer benefits, they also have disadvantages. Being aware of these can help you prepare better.

- Unlimited liability: You are personally responsible for all debts. If the business fails, your personal assets are at risk.

- Limited funding: Raising money can be difficult. Banks and investors may hesitate to lend to a sole proprietor.

- Harder to sell: Selling a sole proprietorship can be challenging. The business is closely tied to you.

- Limited growth: Growth may be limited by your own resources. You may struggle to expand without additional help.

Here’s a summary of the drawbacks:

| Drawback | Description |

| Unlimited Liability | Your personal assets are at risk. |

| Funding Issues | Hard to raise capital. |

| Sale Challenges | Business is tied to you. |

| Growth Limits | Hard to expand without help. |

Partnership

Partnerships are a popular choice for many small businesses. They allow two or more people to work together to run a business. This structure offers shared responsibility and resources. A partnership can help spread the workload and bring different skills to the table. However, it also requires trust and clear communication between partners.

Types Of Partnerships

There are several types of partnerships. Each type has its own rules and benefits. Here are the main types:

- General Partnership: All partners share responsibility for the business. Each partner can make decisions and has equal say.

- Limited Partnership: This includes general partners and limited partners. General partners run the business. Limited partners invest money but do not manage.

- Limited Liability Partnership (LLP): This protects each partner from personal liability. This means if the business has debts, personal assets are safe.

- Joint Venture: This is a temporary partnership for a specific project. Partners share resources for a set period.

| Type of Partnership | Responsibilities | Liability |

| General Partnership | Shared equally | Unlimited liability |

| Limited Partnership | General partners manage; limited partners invest | Limited for limited partners |

| Limited Liability Partnership (LLP) | Shared management | Limited liability for all partners |

| Joint Venture | Shared for a specific project | Depends on the agreement |

Key Considerations

When choosing a partnership, think about several factors. First, consider the level of control. Do you want to share decision-making? Next, think about liability. Some partnerships offer more protection than others. Financial contributions also matter. Discuss how much each partner will invest.

Other important points include:

- Partnership Agreement: This document outlines each partner’s roles. It should detail profit sharing and responsibilities.

- Conflict Resolution: Have a plan for disagreements. This can prevent problems later.

- Exit Strategy: Know how partners can leave the business. This can help avoid conflicts in the future.

Understanding these factors helps create a strong partnership. Clear communication and trust are keys to success.

Limited Liability Company (llc)

Choosing the right business structure is essential for success. One popular option is the Limited Liability Company (LLC). An LLC combines the benefits of a corporation and a partnership. Owners enjoy limited liability protection. This means personal assets are safe from business debts. This structure is flexible and easy to manage. Many small business owners prefer LLCs for these reasons.

Formation Process

Forming an LLC involves several steps. Each step is important to ensure your business is legal and protected. Here is a simple outline of the formation process:

- Choose a Name: Your LLC must have a unique name. It should include “LLC” or “Limited Liability Company”.

- Select a Registered Agent: This person receives legal documents for your LLC. They must be a resident or a business in your state.

- File Articles of Organization: Submit this document to your state’s Secretary of State. It includes basic information about your LLC.

- Draft an Operating Agreement: This document outlines how your LLC will run. It is not always required but is highly recommended.

- Obtain Licenses and Permits: Check local and state laws. You may need specific licenses to operate.

Below is a table summarizing the typical costs involved in forming an LLC:

| Expense | Estimated Cost |

| Name Reservation Fee | $10 – $50 |

| Filing Fee for Articles of Organization | $50 – $500 |

| Registered Agent Fee | $100 – $300 per year |

| Operating Agreement (if needed) | $50 – $100 |

After these steps, your LLC is officially formed. You can start your business with peace of mind.

Tax Implications

LLCs have unique tax benefits. They are known as “pass-through” entities. This means profits and losses pass directly to the owners. Owners report income on their personal tax returns. This can simplify tax filing.

Here are some key tax points for LLCs:

- No corporate tax: LLCs avoid double taxation on profits.

- Flexibility in taxation: Owners can choose how they want to be taxed. Options include being taxed as a sole proprietorship, partnership, or corporation.

- Deductions: LLCs can deduct business expenses, reducing taxable income.

Here’s a quick look at the tax classification options:

| Tax Classification | Description |

| Sole Proprietorship | Single member LLC taxed as an individual. |

| Partnership | Multi-member LLC taxed as a partnership. |

| C-Corporation | LLC elects to be taxed as a corporation. |

| S-Corporation | LLC elects to be taxed as an S-Corp. |

Understanding these tax implications can help you make informed decisions. This knowledge can save money and time.

Corporation

A corporation is a legal entity separate from its owners. It can own property, enter contracts, and be sued. Corporations offer limited liability, meaning owners are not personally responsible for debts. This structure is popular for larger businesses. It provides a way to raise funds by selling shares. Understanding the types of corporations is crucial for entrepreneurs.

C-corp Vs S-corp

Two common types of corporations are C-Corps and S-Corps. Each has distinct features and tax implications. Here’s a simple comparison:

| Feature | C-Corp | S-Corp |

| Tax Treatment | Taxed separately from owners | Pass-through taxation |

| Ownership | No limit on shareholders | Up to 100 shareholders |

| Residency Requirement | None | Must be U.S. citizens or residents |

| Stock Types | Multiple classes of stock | Only one class of stock |

C-Corps are often chosen by large companies. They can attract investors easily. However, they face double taxation. Profits are taxed at the corporate level and again when distributed to shareholders.

S-Corps suit small to medium-sized businesses. They offer pass-through taxation, meaning profits are taxed only at the owner’s personal tax rate. This avoids double taxation. Yet, S-Corps have restrictions on the number and type of shareholders.

Advantages And Disadvantages

Choosing a corporation has both advantages and disadvantages. Understanding these can help in making informed decisions.

- Advantages:

- Limited liability protects personal assets.

- Easy to raise capital through stock sales.

- Perpetual existence, meaning the business continues even if owners change.

- Enhanced credibility with customers and suppliers.

- Disadvantages:

- Higher costs to set up and maintain.

- More regulations and paperwork required.

- Double taxation for C-Corps.

- Limited ownership flexibility for S-Corps.

Understanding these points helps clarify if a corporation is the right choice. Weigh the benefits against the downsides. Make a decision that aligns with your business goals.

Nonprofit Organization

Nonprofit organizations play a vital role in society. They focus on helping others rather than making money. These organizations provide services and support in areas like education, health, and the environment. Understanding their structure helps people see how they operate and benefit communities.

Mission And Purpose

The mission and purpose of a nonprofit organization guide its actions and goals. Each nonprofit has a unique mission statement that explains what it aims to achieve. This statement is often short and clear. It helps both supporters and the public understand the organization’s focus.

Common missions of nonprofit organizations include:

- Promoting education and literacy

- Providing healthcare services

- Supporting environmental conservation

- Advocating for social justice

- Helping the homeless and hungry

A nonprofit’s purpose goes beyond making money. It aims to make a positive impact. Many nonprofits measure their success by the difference they make in people’s lives. This can include:

- Helping people gain skills

- Providing food and shelter

- Improving public health

- Protecting wildlife and natural resources

Nonprofits often engage volunteers to help achieve their mission. Volunteers bring passion and skills without the need for financial compensation. This community involvement strengthens the organization’s connection to its cause.

Funding Sources

Nonprofit organizations rely on various funding sources to support their work. These sources can be diverse, ensuring the organization can continue its mission. Understanding these funding options is crucial for the sustainability of nonprofits.

Common funding sources for nonprofits include:

- Donations: Individuals and businesses contribute money or resources.

- Grants: Government and private foundations provide financial support.

- Membership Fees: Supporters pay to become members, often receiving benefits.

- Fundraising Events: Nonprofits host events to raise money and awareness.

- Corporate Sponsorship: Companies partner with nonprofits for mutual benefits.

Here is a table showing different funding sources and their characteristics:

| Funding Source | Characteristics |

| Donations | Flexible, can be large or small, usually unrestricted. |

| Grants | Often requires an application, may have specific uses. |

| Membership Fees | Creates a committed supporter base, often provides benefits. |

| Fundraising Events | Creates community involvement, promotes awareness. |

| Corporate Sponsorship | Provides funds or resources in exchange for visibility. |

These funding sources allow nonprofits to operate effectively. They help achieve their mission and maintain their programs. Understanding where funds come from is essential for future planning.

Cooperative

Cooperatives are unique business structures. They are owned and operated by a group of individuals. Members come together to meet common needs. These can be related to goods or services. Cooperatives focus on mutual benefits. They provide a way for people to work together. This promotes shared success and community growth.

Structure And Function

Cooperatives have a simple and clear structure. Each member has an equal vote. This means decisions are made democratically. Here are some key features:

- Member Ownership: Members own the cooperative.

- Democratic Control: Each member votes on important issues.

- Profit Sharing: Profits are shared among members based on use.

The primary function of a cooperative is to serve its members. They can operate in various sectors, such as:

- Agriculture

- Retail

- Housing

- Healthcare

Cooperatives often pool resources. This helps to reduce costs and improve services. They can also create a stronger voice in the market. Below is a table showing different types of cooperatives:

| Type of Cooperative | Description |

| Consumer Cooperative | Owned by those who buy goods and services. |

| Worker Cooperative | Owned and managed by the employees. |

| Producer Cooperative | Formed by producers to market their products. |

| Housing Cooperative | Members share ownership of residential properties. |

Cooperatives thrive on community involvement. They aim for long-term sustainability. This creates a better environment for all members.

Member Benefits

Members of cooperatives enjoy several benefits. These advantages arise from their collective efforts. Here are some main benefits:

- Lower Costs: Members can access goods at lower prices.

- Shared Resources: Pooling resources can lead to better services.

- Education and Training: Cooperatives often provide training for members.

Members also have a say in the operations. This increases engagement and satisfaction. Here are some specific member benefits:

- Democratic participation in decision-making.

- Access to capital and financial support.

- Networking opportunities with other members.

Cooperatives aim to improve the quality of life. They often focus on community development. This creates a supportive environment. Members feel valued and connected. The cooperative model fosters trust and cooperation.

Franchise

Franchising is a popular way to start a business. It allows individuals to own a business while using a well-known brand. Franchises are a type of business model that combines the independence of owning a business with the support of a larger company. This structure is appealing for many, especially those who want to enter the market with less risk.

Business Model

A franchise operates under a specific business model. This model allows franchisees to sell products or services under a brand’s name. Here are the main features of the franchise business model:

- Brand Recognition: Franchisees benefit from established brand names.

- Support and Training: Franchisors provide training and ongoing support.

- Standardized Operations: Franchisees follow set processes to maintain consistency.

- Marketing Assistance: Franchisors often handle marketing campaigns.

Many businesses use franchising to expand quickly. The franchisee pays an initial fee and ongoing royalties to the franchisor. Below is a simple table explaining these costs:

| Cost Type | Details |

| Initial Franchise Fee | A one-time fee to join the franchise. |

| Ongoing Royalties | A percentage of sales paid to the franchisor. |

| Advertising Fees | Contributions to national marketing efforts. |

This model can lead to quick growth for both franchisees and franchisors. It creates a win-win situation for everyone involved.

Franchisee Responsibilities

Franchisees have specific responsibilities to ensure success. They must follow the franchisor’s guidelines closely. Here are some key responsibilities:

- Adhere to Brand Standards: Maintain the quality and image of the brand.

- Manage Daily Operations: Oversee staff, inventory, and customer service.

- Financial Management: Handle budgeting, sales tracking, and expenses.

- Report Performance: Regularly update the franchisor on business performance.

Franchisees should also engage with the community. Building relationships can enhance the brand’s reputation. Below is a list of tasks franchisees often perform:

- Participate in local events.

- Build partnerships with local businesses.

- Collect feedback from customers.

These responsibilities are crucial. They help the franchise thrive and contribute to the overall success of the brand.

Choosing The Right Structure

Choosing the right business structure is crucial for any entrepreneur. The structure affects taxes, liability, and decision-making. A well-chosen structure can support growth and protect personal assets. Understanding the options helps in making an informed decision.

Factors To Consider

Several factors influence the choice of a business structure. These factors include:

- Liability Protection: How much personal risk are you willing to take?

- Tax Implications: Different structures have various tax treatments.

- Control: How much control do you want over the business?

- Funding Needs: Will you need investors or loans?

- Future Plans: Do you plan to expand or sell the business?

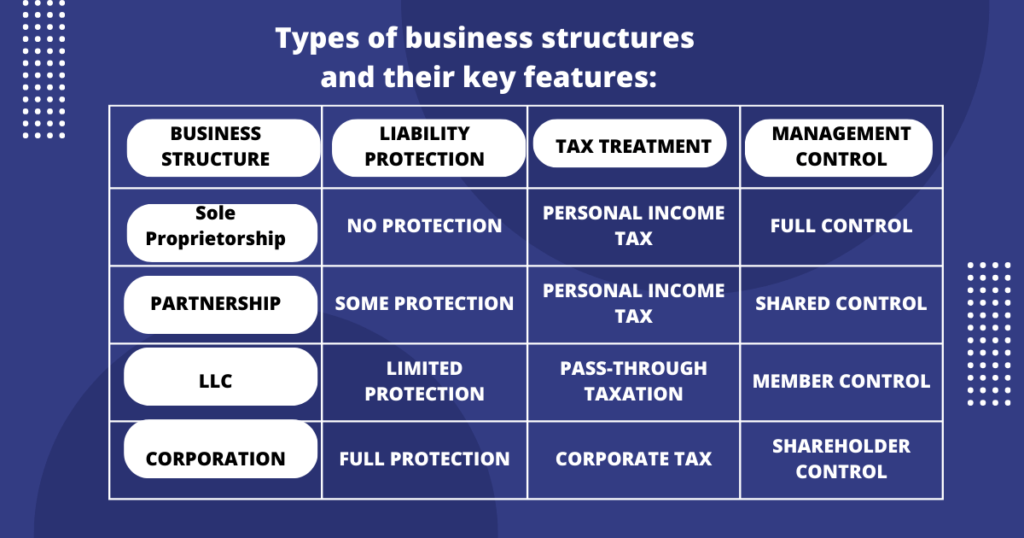

Here’s a table that summarizes common business structures and their key features:

| Business Structure | Liability Protection | Tax Treatment | Management Control |

| Sole Proprietorship | No protection | Personal income tax | Full control |

| Partnership | Some protection | Personal income tax | Shared control |

| LLC | Limited protection | Pass-through taxation | Member control |

| Corporation | Full protection | Corporate tax | Shareholder control |

Assess these factors carefully. They will guide your decision on the best structure for your business.

Long-term Goals

Your long-term goals play a significant role in determining the right business structure. Consider what you want to achieve in the future. This can shape your choice.

- Growth Potential: Do you plan to grow your business quickly?

- Exit Strategy: Are you considering selling the business later?

- Investment Needs: Will you require funding from investors?

- Succession Planning: How will you pass the business to others?

For example, if you want to expand quickly, an LLC or corporation may suit your needs. These structures attract investors more easily. They also provide better liability protection. In contrast, a sole proprietorship might limit your growth. It may not appeal to investors.

Think about your goals. Align them with the business structure you choose. This alignment supports your vision for the future.

Frequently Asked Questions

What Are The Common Types Of Business Structures?

The most common types of business structures include sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Each structure has unique features, benefits, and limitations. Understanding these types helps you choose the best fit for your business goals and legal needs.

How Do I Choose A Business Structure?

Choosing a business structure depends on various factors. Consider aspects like liability, taxation, and management. Evaluate your business size, industry, and future goals. Consulting with a legal or financial advisor can provide valuable insights tailored to your specific situation.

What Is A Sole Proprietorship?

A sole proprietorship is a business owned by one individual. It’s the simplest and most common structure, requiring minimal paperwork. The owner has complete control but also bears all liability. This structure is ideal for small businesses and freelancers seeking flexibility and ease of operation.

What Is The Difference Between Llc And Corporation?

An LLC offers limited liability protection with flexible management, while a corporation is a separate legal entity with stricter regulations. Corporations face double taxation on profits, while LLCs typically enjoy pass-through taxation. Your choice should depend on your business goals and desired level of complexity.

Conclusion

Choosing the right business structure is important. Each type has its own benefits. Consider your goals and needs carefully. Think about taxes, liability, and management. Make an informed choice that fits your vision. This decision can shape your business’s future.

Take your time to explore each option. Understand the differences before you decide. Your business structure can help you succeed. Choose wisely for the best results.